new mexico gross receipts tax return

Deadline to File Tax Returns to Avoid Late-Filing Penalty. 1 Effective July 1 2021 the new law revises and expands recently enacted destination-based sourcing rules with respect to the gross receipts tax.

-1.jpg)

Calculating Nm Gross Receipts Larry Hess Cpa Albuquerque

Report the regular gross receipts tax the leased vehicle gross receipts tax and the leased vehicle surcharge on the CRS-1 Form.

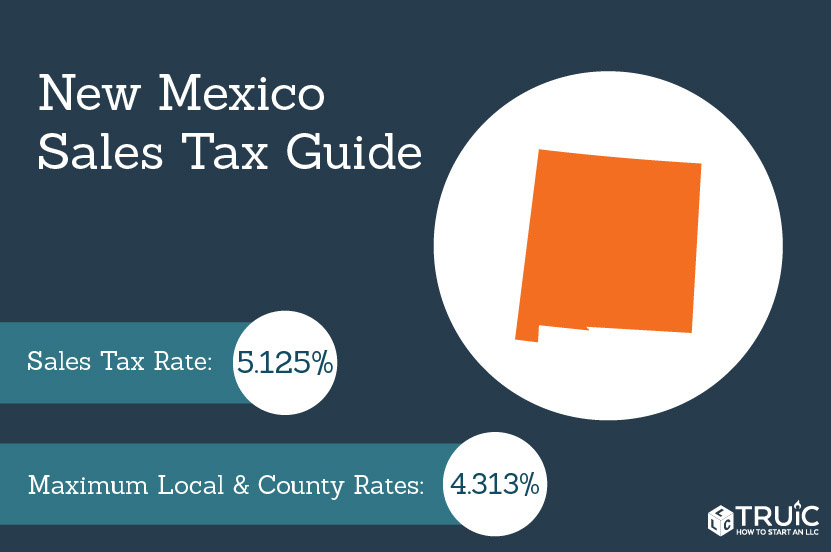

. Gross Receipts TaxCompensating Tax. The same goes for those who sell research and development services performed outside New Mexico when the resulting product is initially used here. New Mexico has a statewide gross receipts tax rate of 5125 which has been in place since 1933.

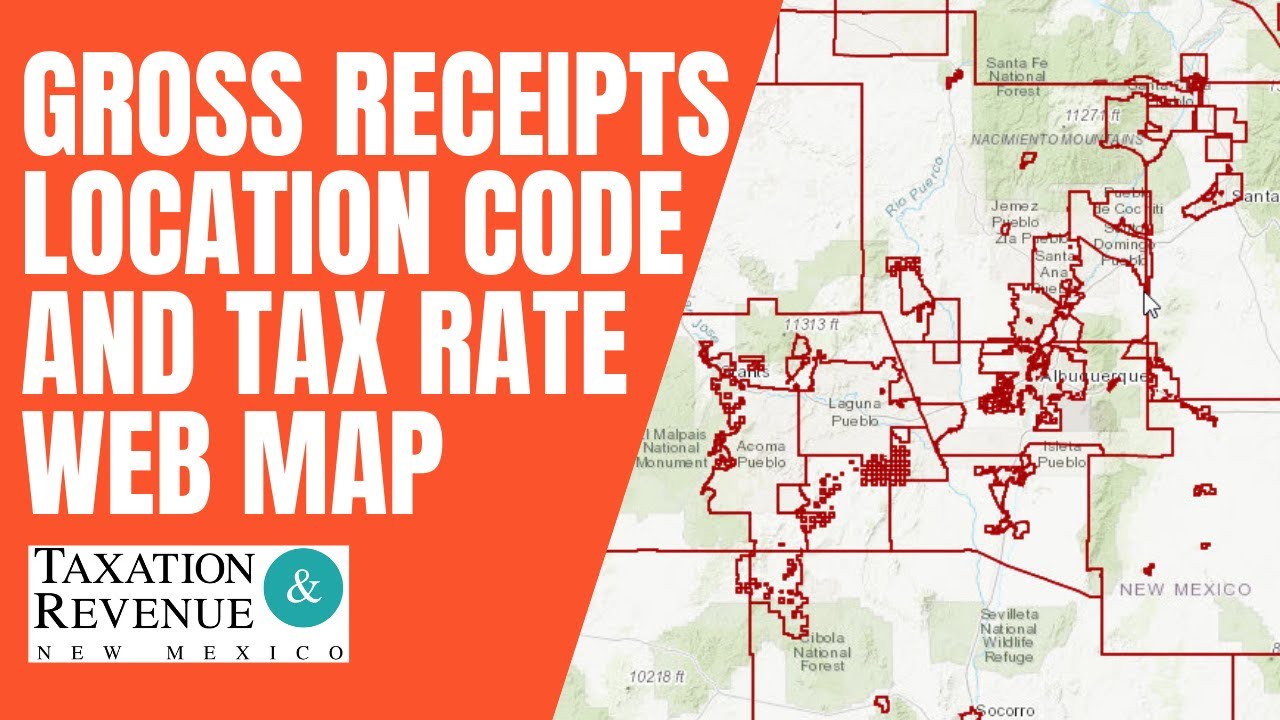

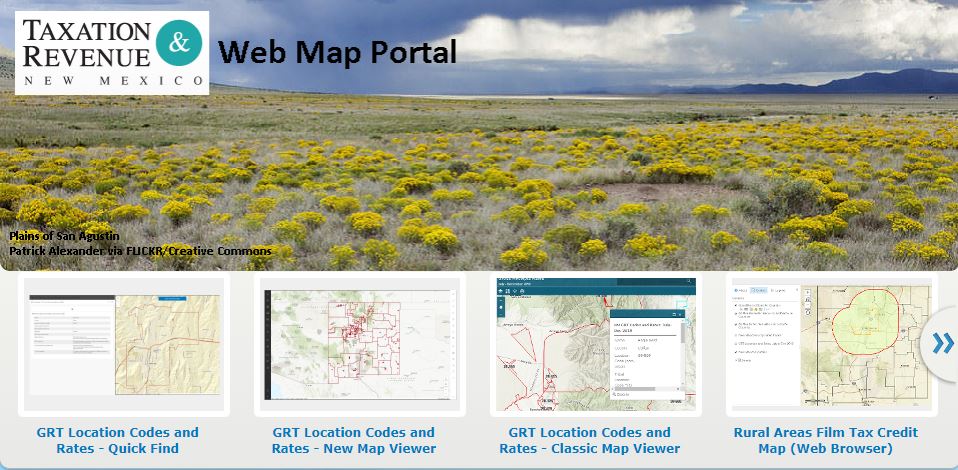

Gross Receipts Location Code and Tax Rate Map. Sales tax is a tax paid to a governing body state or local on the sale of certain goods and services. New Mexico Taxpayer Access Point allows taxpayers to file their taxes make payments check refund statuses manage their tax accounts register new businesses and more.

By June 30 2021 in Avalara AvaTax create a new filing request for the NM Compensating Tax return. The changes to the GRT came primarily in response to the US. They offer faster service than transactions via mail or in person.

TRD administers several tax programs all of which may be affected. Effective July 1 2021 most businesses will collect the Gross Receipts Tax based on the rate where their goods or products of their services are delivered. New Mexicos gross receipts tax is admittedly confusing but the state still expects businesses to follow the law and pay what they owe from the sale of property or services.

Personal Income Tax Gross Receipts Tax also known as CRS Combined Reporting System. Deadline to Pay in Full to Qualify for Relief. Frequently Asked Questions.

On March 9 2020 New Mexico Gov. March 25 2020 July 25 2020. The gross receipts tax rate varies throughout the state from 5125 to 86875 depending on the location of the business.

It varies because the total rate combines rates imposed by the state counties and if applicable municipalities where the businesses are located. Economic Statistical Information. Filing online is fast efficient easy and user friendly.

For fiduciaries that file on a calendar-year basis the New Mexico FID-1 New Mexico Fiduciary Income Tax Return is due on or before April 15 with the payment of taxes due. Gross Receipts by Geographic Area and 6-digit NAICS Code. Filing your Gross Receipts Tax GRT online takes the stress out of work so you have time for more enjoyable things.

The TaxJar API has been updated to reflect destination-based sourcing effective July 1 2021. Avalara will expire the NM SRS1 Long Form Combined and will update to the Gross Receipts Tax return form USNMTRD41413 with an effective date of 612021. Technology jobs tax credit may be applied against gross receipts compensating or withholding tax.

A 2-per-day leased vehicle surcharge is also imposed on certain vehicle leases. Laboratory partnership with small business tax credit may be claimed only by national laboratories operating in New Mexico and is applied against gross receipts taxes due up to 1800000 excluding local option gross receipts taxes. Calculation of 112 Increment for the.

A gross receipts tax permit can be obtained by registering for a CRS Identification Number online or submitting the paper form ACD-31015. Existing AvaTax Returns customers who have an active NM scheduled return in AvaTax. On April 4 2019 New Mexico Gov.

Michelle Lujan Grisham signed legislation amending certain provisions of the New Mexico gross receipts tax. In-State Veteran Preference Certification. As for payment E-pay is the quick and green way to.

NM Business Taxes. Personal Income Tax and Corporate Income Tax. The tax is imposed on the gross receipts of businesses or people who sell property perform services lease or license property or license a franchise in New Mexico.

Information needed to register includes the. Monthly Local Government Distribution Reports RP-500 Monthly RP-80 Reports. Seven states currently levy gross receipts taxes while several others including Pennsylvania South Carolina Virginia and West Virginia permit local taxes imposed on a gross receipts base.

Gross Receipts by Geographic Area and NAICS Code. Monthly Local Government Distribution Reports RP-500 Gross Receipts by Location. By Finance New Mexico.

Electronic transactions are safe and secure. In a nutshell GRT is a substitute for the traditional sales tax that shoppers in other states pay when they make a purchase. After registering the business will be issued a Combined Reporting System CRS Number sometimes known as a New Mexico Tax Identification Number.

Receipts from selling livestock and the receipts of growers producers and trappers from selling live poultry unprocessed agricultural products for example a bale of hay a head of lettuce or an unroasted sack of green chili hides or. Confidentiality of Tax Return Information. April 15 2020 July 15 2020.

We urge you to give it a try. Michelle Lujan Grisham signed House Bill HB 6 enacting major changes in the states corporate income tax and gross receipts tax GRT regimes. Collection and distribution data of the gross receipts tax are also provided in the Monthly Local Government Distribution or RP-500 reports.

Municipal governments in New Mexico are also allowed to collect a local-option sales tax that ranges from 0 to 9062 across the state with an average local tax of 2258 for a total of 7383 when combined with the state sales tax. On top of the state gross receipts tax there may be one or more local taxes as well as one or more special. Remote sellers will now pay both the statewide rate and local-option Gross Receipts Taxes.

Taxation and Revenue New Mexico. Supreme Court decision in South Dakota v. The location code for leased vehicle gross receipts tax is 44-444 and the location code for the leased vehicle surcharge is 44-455.

These taxes land on businesses and capture business-to-business transactions in addition to final consumer purchases leading to tax pyramiding. Corporate Income Franchise Tax. New Mexico first adopted a version called a gross receipts tax in 1933 and since that time the rate has risen to 5125 percent.

The business pays the total gross receipts tax to the state which then. T 1 215 814 1743. The following receipts are exempt from the NM gross receipts tax sales tax.

New Mexico Gross Receipts Tax Nmgrt Law 4 Small Business P C L4sb

Gross Receipts Location Code And Tax Rate Map Governments

Filers Kit Taxation And Revenue Department State Of New Mexico

Reporting Locations And Claiming Deductions For Gross Receipts Tax Youtube

Gross Receipts Location Code And Tax Rate Map Governments

How To File A Gross Receipts Tax Grt Return In Taxpayer Access Point Tap Youtube

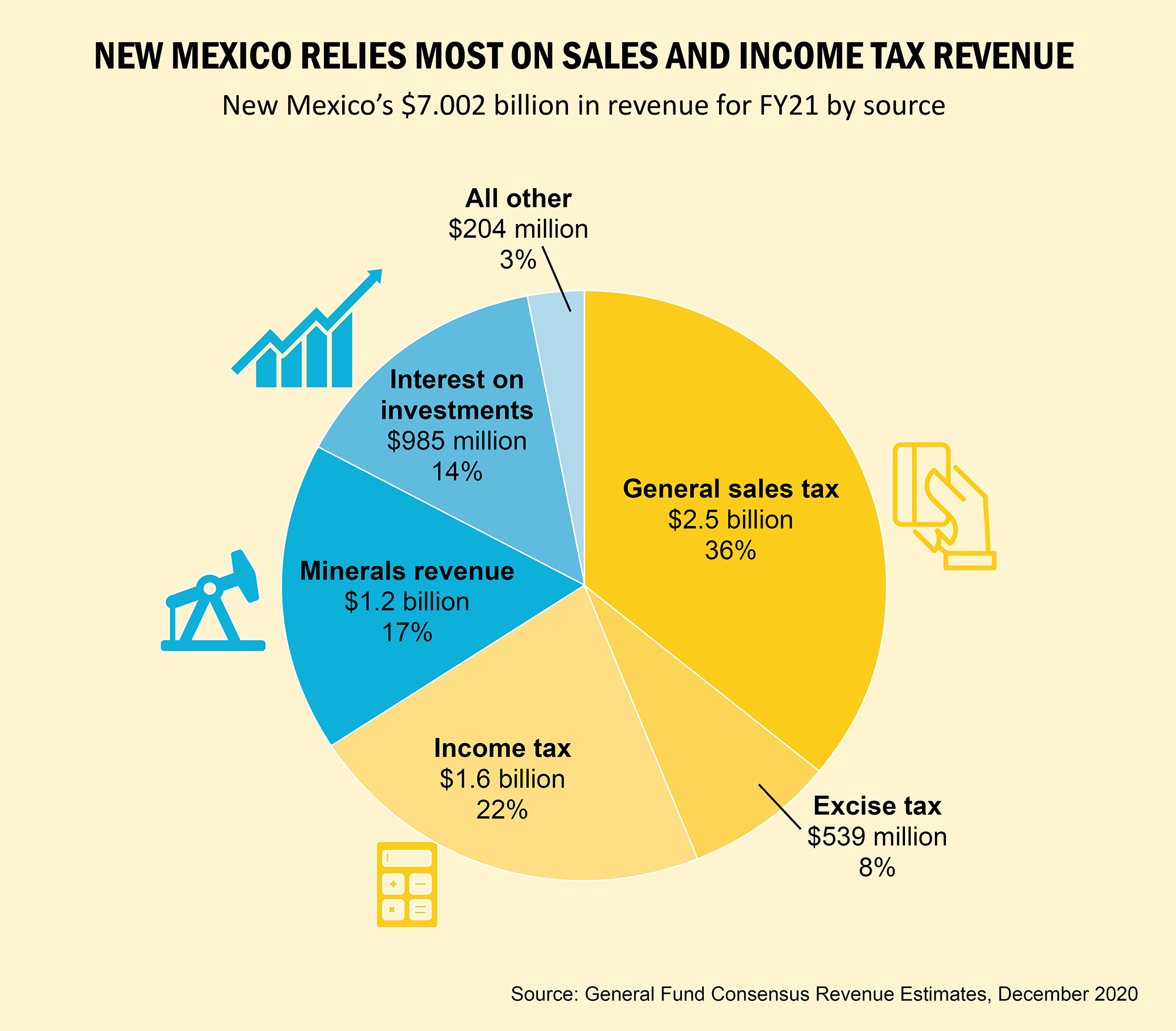

A Guide To New Mexico S Tax System Executive Summary New Mexico Voices For Children

News Alerts Taxation And Revenue New Mexico

Tax News Views Podcast Gross Receipts Deloitte Us

New Mexico Sales Tax Small Business Guide Truic

Revenue Windfall Could Prompt Tax Cut Talks Albuquerque Journal

How To File A Gross Receipts Tax Grt Return In Taxpayer Access Point Tap Youtube

A Guide To New Mexico S Tax System New Mexico Voices For Children

Lithuania Makes 1 Billion Dollars In Tourism Tourism Map Infographic Map